Friday, 30 May 2025

While overall volumes are in decline, there are some areas of growth for dairy. Changes in consumer preferences are driving growth from certain categories, and stem from several key drivers: increased demand for higher protein content, rising interest in gut health, growing scepticism towards ultra-processed foods (UPFs) and a surge in demand for naturalness. Many of these trends are circulating on social media and, as a result, products such as cottage cheese, whole milk and kefir yogurt have seen noticeable growth.

Cottage cheese

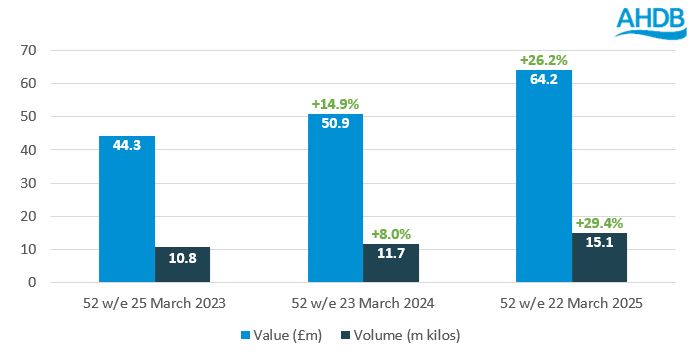

Cottage cheese is experiencing a notable resurgence recently, with year-on-year increases of 26.2% in value and 29.4% in volume (NIQ Panel on demand, 52 w/e 22 March 2025). This growth has been amplified by rising social media trends such as meal prepping, where cottage cheese is often highlighted as a versatile and nutritious ingredient that pairs well with various foods and contains high levels of protein.

Growth of cottage cheese in value (£m) and volume (m kilos)

Source: NIQ Panel on demand, 52 w/e 22 March 2025

Cottage cheese is gaining share within the cow cheese category now accounting for 4.3% of volume sales, as total cow cheese saw a 4.5% year-on-year increase in volume (NIQ Panel on demand, 52 w/e 22 March 2025). This growth is partly driven by rising health consciousness, as consumers increasingly prioritise protein content in their food choices. Plain cottage cheese supports this trend, providing 9.4g of protein per 100g in the full-fat variety and 10.6g of protein per 100g in the reduced fat version (McCance and Widdowson). As of December 2024, 28% of shoppers reported actively boosting their protein intake, with a further 29% indicating plans to increase it throughout 2025 (IGD ShopperVista, December 2024).

This demand for high protein foods is seen especially among consumers seeking functional foods to support their fitness goals, driving the success of protein-forward products, according to Mintel (British Lifestyles – UK – 2025). This is also confirmed within AHDB’s Consumer Tracker, where 21% of respondents said they are concerned about protein content when choosing food, a 3%pt increase compared to the last quarter (AHDB/YouGov Consumer Tracker, February 2025).

Kefir yogurt

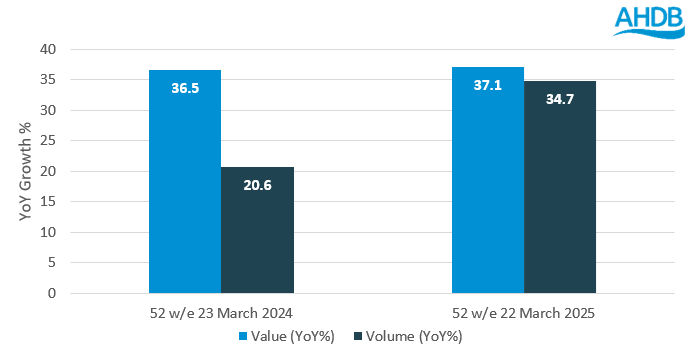

Kefir, a cultured, fermented milk drink, is a smaller segment within yogurt and yogurt drinks but has seen a strong performance, seeing year-on-year increases in both value (+37.1%) and volume (+34.7%), contributing positively to the overall growth of the category. According to Nielsen, cow’s yogurt saw a year-on-year increase of 7.9% in 2024 (NIQ Panel on demand, 52 w/e 22 March 2025).

Year-on-year growth % of value and volume for kefir yogurt and drinks

Source: NIQ Panel on demand, 52 w/e 22 March 2025

More consumers are prioritising health in food choices and demand is rising for foods containing functional benefits such as gut health, with a significant 75% of breakfast consumers finding breakfast foods that support digestive health appealing (Mintel, British Lifestyles, 2025). At the same time, 72% of consumers agree that there is an abundance of foods that have added ingredients that make them unhealthy (IGD, ShopperVista, April 2025), and many are gradually shifting away from those with exhaustive ingredient lists or added ingredients perceived as unhealthy. This is also backed up by AHDB’s Consumer Tracker, with 16% of respondents who are looking to cut back on dairy saying avoiding processed foods is a factor to reduce their dairy intake (AHDB/YouGov, February 2025).

However, not all dairy is equally affected, as kefir benefits from this shift. As kefir undergoes a natural fermentation process, as highlighted in our digesting the fermented trend article, and is packed with high levels of probiotics that support gut health (Euromonitor International, Dairy Products and Alternatives industry edition 2024), it is positioned as a healthier choice that appeals to these trends and an ideal product for breakfast occasions.

Whole milk

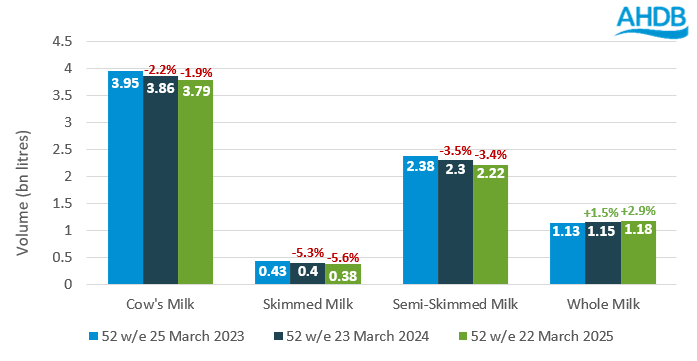

Whole milk is also experiencing growth, seeing a year-on-year increase of 2.9% in volume in the most recent 12 months, with growth in shares now making up 31% of volume sales within the cow’s milk category. According to Nielsen, cow’s milk experienced a year-on-year volume decline of 1.9% in 2024 (NIQ Panel on demand, 52 w/e 22 March 2025).

Growth of cow’s milk categories in volume (bn litres)

Source: NIQ Panel on demand, 52 w/e 22 March 2025

As highlighted previously, more consumers are focused on health and wellness when making food choices. Specifically for milk, according to Mintel, cow’s milk is often seen as minimally processed, with 63% of consumers prioritising its naturalness over its nutritional content, making it a preferred choice amid the spotlight on UPFs (Mintel, Dairy and Dairy Alternative Drinks, Milk and cream, 2024). In addition, Kantar reports that the naturalness and less-processed nature of whole milk is one of the main reasons behind its consumption, making up 15.3% of total servings in 2024 (Kantar Usage, Occasions Type & Needs Servings, 52 w/e 29 Dec 2024). This perception strengthens the demand for whole milk, as its single-sourced origin and lack of added flavouring highlights it as a more natural choice that aligns well with consumers’ health goals.

Key takeaways

- Emphasising the natural nutritional content and simplicity of dairy products is key to align with the demand for natural products

- Protein content is gradually becoming a leading factor when making food choices, making it essential to highlight the naturally high protein levels in dairy products

- Gut health is becoming a major focus for consumers, especially breakfast eaters, making it important to spotlight natural digestive benefits in dairy products and promote them in breakfast occasions

- Social media is a major driver of health trends, presenting a valuable opportunity to raise awareness, influence consumer perceptions and generate demand, especially for younger consumers

- For more detailed dairy performance, please see our Dairy retail dashboard

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.