Friday, 6 June 2025

- Nov-25 UK feed wheat futures dipped by £0.15/t yesterday, closing at £179.35/t. Meanwhile, the May-26 contract saw modest support, rising £0.30/t to finish the session at £191.30/t.

- Domestic wheat futures tracked the drop in European prices yesterday. Paris milling wheat futures (Dec-25) fell by 0.2%, pressured by a stronger euro against the US dollar and improved harvest prospects in the Northern Hemisphere. In contrast, Chicago wheat futures (Dec-25) gained 0.4%, on short covering and rising tension in the Black Sea region.

- Paris rapeseed futures (Nov-25) closed yesterday at €485.75/t, up €2.50/t. The gain reflected broader strength in the oilseed complex, with Chicago soyabean and Winnipeg canola futures (Nov-25) both rising by 1%.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

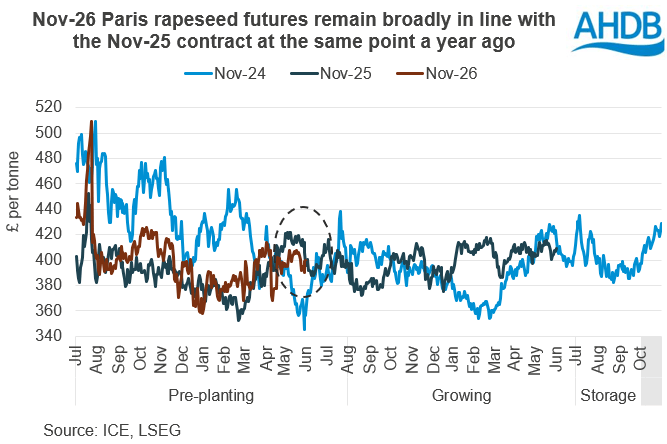

With decision making for the 2026 crop underway, it is a good time to keep a close eye on how prices are moving. Today we are focusing on rapeseed prices, which take their lead from Paris rapeseed futures.

There is limited trading yet on the Nov-26 futures so the prices are primarily driven by the outlook for 2025/26.

Paris rapeseed futures have edged up recently, supported by tight global supplies and ongoing geopolitical tensions. Yesterday, Nov-25 Paris rapeseed futures closed at £408.95/t, up £22.64/t (6%) since its low so far this year in mid-March.

This resulted in a similar upward trend in the Nov-26 Paris rapeseed futures, which closed at £399.48/t yesterday, up more than £31/t (9%) since mid-April. Interestingly, the current Nov-26 price is also £3.79/t higher than where the Nov-25 price stood at the same point last year, prior to the start of planting.

What are the factors driving the market?

Although early USDA forecasts point to a larger global rapeseed crop in 2025/26, the outlook is not straightforward. Weather remains a major concern, with mixed prospects across key regions.

After last year’s rain-hit harvest, EU’s rapeseed production is expected to return to above-average levels at 18.8 Mt (EU Commission). However, crop stress is still a concern in France, Germany, and Poland. The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) forecasts a 6% year-on-year drop in production for 2025/26, though output is still expected to remain above the long-term average.

In Canada, rapeseed production in 2026 is up by approximately 1% on the year. However, total supplies are down 6% year-on-year, driven by lower yields and sharply reduced carry-in stocks (Statistics Canada). Meanwhile, in Ukraine, USDA’s estimates suggest a 100 Kt drop in rapeseed production for 2025 due to warm weather and ongoing conflict.

Looking ahead

Prices for the 2026 crop will continue to evolve, driven first by harvest prospects and results for the 2025 crop. However, as information on planting progress and areas for harvest 2026 emerges later in the year, this will also influence harvest 2026 prices.

Keeping up with price trends can help you manage risks in a changing market. AHDB’s Farmbench will help you understand what your previous crops have cost and create budgets. The online tool will also allow you compare your farm to similar businesses and create budgets.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.