- Beef and Lamb New Zealand forecast the lamb crop of spring 2024 down by 7.6% from the exceptional lamb crop in 2023.

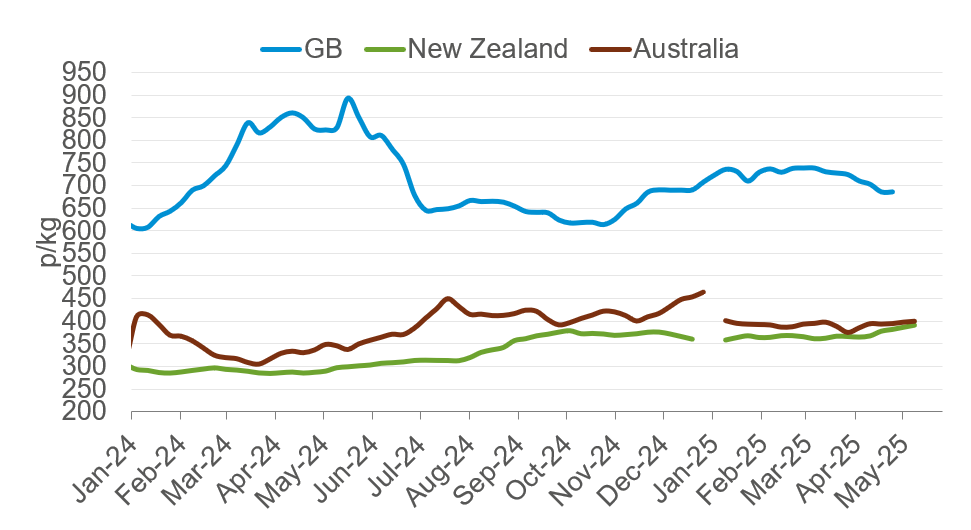

- As of the week ending the 6 June, the New Zealand lamb price was 313 pence below the GB lamb price and just 50 pence below the Australian price.

- However, reports suggest that these increased domestic prices have not limited NZ’s ability to trade, with average export values also on the rise.

Beef and Lamb New Zealand forecast the lamb crop of spring 2024 (September-November) to total 19.5 million, down by 7.6% from the exceptional lamb crop in 2023. This fall in lamb numbers was driven by both a reduction in breeding ewes and a reduced lambing percentage following drought conditions.

It is these reduced lamb numbers that are expected to reduce total lamb production for the 2024/2025 season, down by 6.6% to an estimated 325.8 thousand tonnes. This supply tightness is present across both the North and the South Island.

In the North Island, lamb slaughter for the season to date (data to 17th May) is tracking 1.9% below last year’s levels, with sharp declines in slaughter over the past couple of weeks causing some plants to reduce their kill capacity to two-day weeks.

This unseasonably early fall-off in slaughter was somewhat expected after positive growth rates over the spring and summer brought lambs forward earlier than anticipated. This drove estimated slaughter up to a peak above last year’s levels in the summer. Moreover, the incredibly competitive store market has also reduced the number of lambs available for slaughter as finishers and processors compete for available lambs.

Meanwhile in the South Island, lamb shortages were slightly delayed compared to the North. However, the most recent available data estimates slaughter to be down by -14% % (-1.1 million head) for the year to date as of the 17th of May.

Once again strong store markets are impacting the availability of finished lambs, however it is also thought that the storms in the early spring and summer may have had a greater impact on South Island sheep populations than initially forecast.

In the wake of this supply tightness the New Zealand overall deadweight price has risen gradually over the past 9 weeks to stand at an average of 917.50 $/kg (408p/kg) as of the week ending the 6 June, bringing the New Zealand lamb price 313 pence below the GB lamb price and just 50 pence below the Australian price.

GB, New Zealand and Australian deadweight lamb prices p/kg

Source: AHDB, MLA, NZ AgriHQ

Trade

So far, reports suggest that these increased domestic prices have not limited NZ’s international trade, with average export values also on the rise.

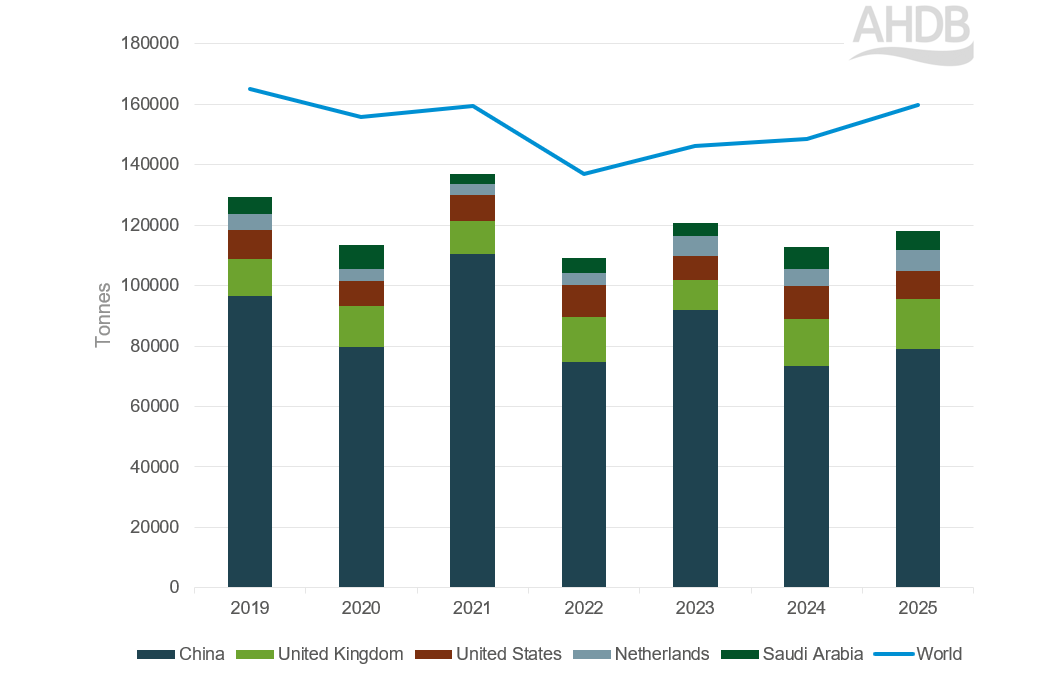

Indeed, in the year to date (Jan- April) New Zealand exported approximately 160 thousand tonnes of sheep meat, up 8% on the year, with growth to China, UK and Netherlands driving these increases.

New Zealand sheep meat exports by destination, YTD (Jan-April)

Source: TDM LLC

In terms of products, frozen, bone in cuts (i.e. legs) continue dominate NZ export volumes, making up 66% of total exported volumes in the period from January to April this year. This is followed by frozen half and whole carcases of sheep making up 10% of volumes, and frozen boneless cuts making up a further 9% of volumes.

The UK preference for higher value cuts is reflected in annual trade data. In 2024 NZ sheep meat exports to the UK were worth £209 million, providing 12% of the value of total NZ sheep meat exports whilst representing 12% of the volumes. Meanwhile the value of the total sheep meat exports to China in 2024 was worth £454million, just 26% of New Zealand’s sheep meat export value whilst providing 43% of total volumes. This highlights the importance of UK exports to deliver value back to the NZ sheep market.

What could this mean for the UK?

The United Kingdom has free trade agreements with both New Zealand and Australia, allowing market access for lamb in varying quantities. In the year to March 2025 the UK has imported 19,000 tonnes of sheep meat, of which 64% was imported from New Zealand, and 22% was from Australia.

As New Zealand domestic sheep prices rise, there is a risk that this could begin to weigh on export capability, as their product could become less competitive on the global market, particularly against Australia. However, it also important to recognise that New Zealand exports up to 95% of its total sheep meat production, and as previously mentioned the UK is a key high value market for these exports, meaning it is unlikely we will see a marked reduction in New Zealand lamb on UK shelves for the foreseeable future.