Thursday, 12 June 2025

- UK feed wheat futures (Nov-25) closed at £177.00/t yesterday, down £0.30/t from Wednesday’s close. The May-26 contract fell £0.45/t over the same period, to close at a new contract low of £187.50/t.

- Domestic wheat prices followed movements global grain markets yesterday. Chicago wheat and Paris milling wheat futures (Dec-25) fell 1.2% and 0.7% respectively yesterday. Improving wheat crop conditions in the US and EU are pressuring the market.

- Nov-25 Paris rapeseed futures ended yesterday’s session at €487.75/t, down €1.50/t (0.3%) from Wednesday’s session.

- Winnipeg canola futures increased 2.1%, while Chicago soyabean (Nov-25) were down by 0.2%. Tighter supplies of old crops and concerns over the new crop in Canada underpinned canola prices.

- The oilseeds market is fluctuating amid a rally in crude oil futures, supported by mounting concerns in the Middle East, but fears over potential falls in biodiesel mandates in the US.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

The USDA’s World Agricultural Supply and Demand Estimates (WASDE) report, released yesterday, updated the expected figures for the 2025/26 season.

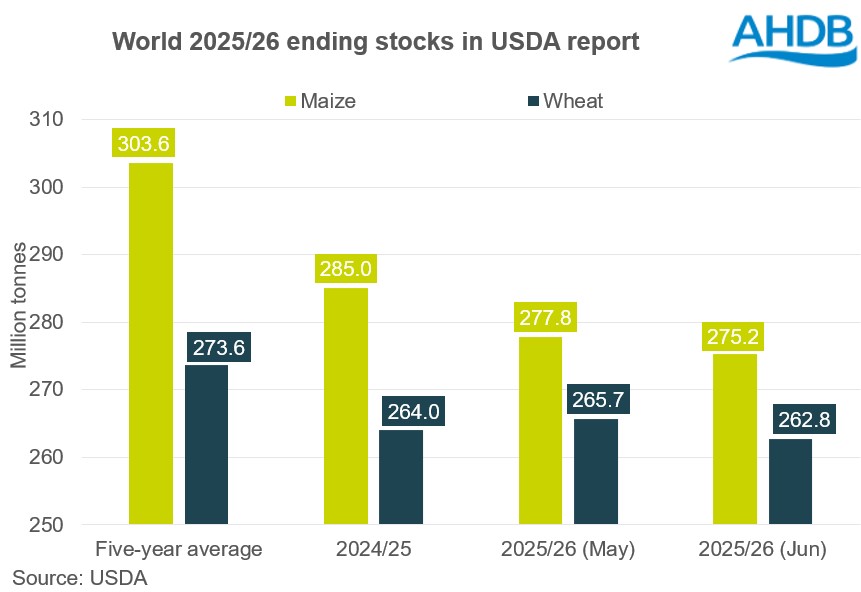

In its June forecast, the USDA put the world’s wheat ending stocks at 262.8 Mt, down from 265.7 Mt in the May report and 4% lower than the last five-year average. This was below the average trade estimate of 265.1 Mt primarily due to lower beginning stocks, increased consumption, and higher exports. The report showed increased exports from the US and the EU compared to May.

Meanwhile, the USDA’s estimate for UK wheat production in 2025/26 had a downward revision from 13.0 Mt to 12.8 Mt.

World maize production in 2025/26 is forecast 1.0 Mt higher compared to May figures. However, consumption is also expected to rise more than in May. As a result, the USDA estimates that world maize ending stocks at 275.2 Mt, 2.6 Mt lower than in May and 9% lower than the last five-year average. This was also below the average trade estimate for June of 278.8 Mt.

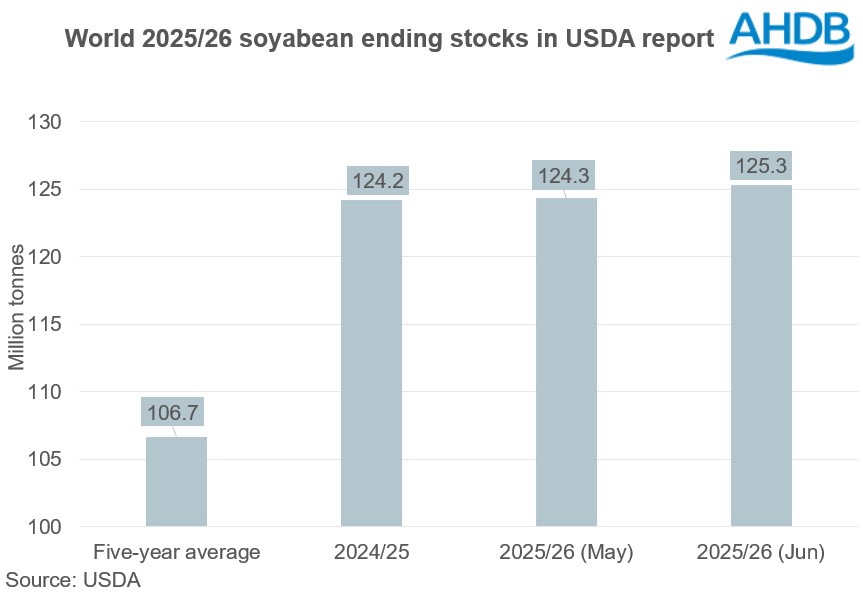

The global soyabean supply and demand forecasts for 2025/26 include an increase in beginning stocks compared to last month, no change in production and only a slight increase in crushing. This resulted in an increase in ending stocks, which are expected to reach 125.3 Mt, surpassing the average trade estimate of 124.5 Mt.

What does this mean for prices?

Despite lower-than-average trade estimates world ending stocks of wheat for the 2025/26 season, Chicago and Paris wheat futures closed lower yesterday. Other factors, such as the improved crop conditions in the US and EU, meant this report was unable to support prices.

Fundamentally, we are seeing a trend of falling global wheat and maize stocks but rising soyabean stocks. In the short term, further decreases in grain prices are possible due to the approaching harvesting campaign in the Northern Hemisphere and improving crop conditions. However, the long-term trend of decreasing world ending stocks of wheat and maize could support grain prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.