Despite the increased participation, consumers remained cautious with spending, and over half of Easter eggs were bought on deals (Kantar, 2 w/e 20 April 2025 vs 2 w/e 31 March 2024*). This reflects a competitive pricing environment, and a shopper focus on maximising promotions. Overall, Easter grocery sales hit £9.2 billion, a 4.9% increase from Easter 2024 (Kantar, 4 w/e 20 April 2025).

Decline in Easter roasts

While grocery sales saw growth this Easter, the total meat, fish, and poultry (MFP) category remained flat, with primary red meat limiting overall MFP results with a 4.7% decline in volumes purchased (Kantar, 2 w/e 20 April 2025).

Value and volume red meat performance at Easter 2025

|

Vs 2024 |

Total MFP |

Red meat |

Lamb |

Beef |

Pigmeat |

|

Volume |

-0.0% |

-4.7% |

-7.9% |

-0.3% |

-1.3% |

|

Value |

+3.4% |

+0.6% |

-8.0% |

+8.4% |

-3.1% |

Source: Kantar, MFP performance, 2 w/e 20 April 2025

A key driver of the reduced red meat performance was roasting joints. While shoppers spent £105 million on primary red meat roasting joints (beef, lamb, pork) in the two weeks leading to Easter, this was down 2.0% from 2024. A reduction in shopper numbers was influential in this, declining by 2.0 percentage points (ppts) despite a decrease in average prices paid (Kantar, 2 w/e 20 April 2025).

Value and volume of red meat roasting joints at Easter 2025

|

Vs 2024 |

Primary lamb roasting |

Primary beef roasting |

Primary pork roasting |

|

Volume |

-5.3% |

+13.2% |

-12.2% |

|

Value |

-7.0% |

+9.7% |

-4.9% |

Source: Kantar, MFP performance, 2 w/e 20 April 2025

Beef boosted volumes this Easter

Although most people see lamb as the traditional Easter roast, it was actually beef which had the best red meat roasting performance this year. In the 2 w/e 20 April 2025, £33.7m was spent on beef roasting, and increase of 9.7% on Easter 2024. But it wasn’t just price inflation increasing spend, as volumes purchased increased by 13.2% to 3.6m KG (Kantar).

As a result, beef roasting increased its volume share of red meat roasting joints to 31.1%, an increase of 4.1ppts year-on-year. For cost conscious shoppers, the fact that beef roasting is consistently cheaper than lamb roasting will have been a tempting factor. This year beef roasting was on average 79p/kg cheaper than lamb roasting, despite seeing significantly less promotional activity.

Lamb roasting: A mixed performance

While lamb accounted for over half (50.8%) of primary red meat roasting joints sold in the two weeks to Easter, it underperformed relative to last year’s strong results. A few shoppers started early but many until the week before Easter to make their purchases of lamb roasting. While there was a 194% increase in volumes purchases week-on-week, this wasn’t enough to offset the slower start for purchases which limited Easter performance (Kantar, 2 w/e 20 April 2025).

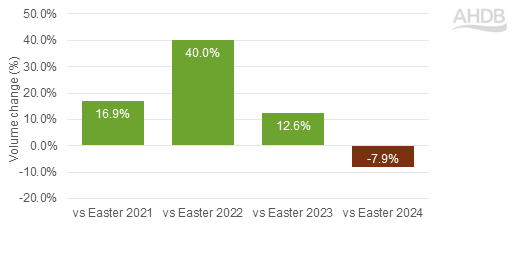

However, when comparing lamb roasting volumes to earlier Easters (2021-2023), 2025 still showed a significantly stronger performance.

Volume performance of lamb roasting joints at Easter 2025 vs the previous 4 years

Source: Kantar, volume change for 2 w/e 20 April 2025, vs Easter 2021-2024

Despite the underperformance compared to 2024, lambs share of MFP volumes rose to 6.3% during Easter compared to 2.4% for the rest of the year. This highlights Easter’s critical role for lamb sales and consumer preference for this protein during the spring holiday (Kantar, 2 w/e 20 April 2025 vs average 2-week period excluding Christmas for the 48 w/e 23 March).

It should also be noted that Easter 2024 coincided with the Muslim festivals of Ramadan and Eid al-Fitr. Lamb is an important protein for these celebrations, and in 2025 these celebrations fell 3 weeks prior to the Easter weekend which may have impacted on lamb demand.

The power of promotions

Promotions, especially temporary price reductions (TPRs), were overall notably higher this Easter, and primary red meat saw promotional activity more than double compared to a typical two-week period (Kantar, 2 w/e 20 April 2025 vs average 2 weeks period in the 48 w/e 23 March, excluding Christmas).

At Easter 2025, 54.6% of roasting joints were sold on promotion, up 3.8 ppts from 2024 and 11.0 ppts higher than 2023. Lamb roasting had an even higher promotional share than total roasting joints at 62.2% (Kantar, 2 w/e 20 April 2025).

Despite increased promotions, lamb and pork roasting joints did not see overall volume growth, as declines in non-promotional sales offset gains in promotional purchases (Kantar, 2 w/e 20 April 2025).

While beef roasting joints saw overall volume increases, this wasn’t achieved through promotional purchases which were actually seen to decrease year-on-year. This suggests that promotional pricing alone isn’t sufficient for sustained growth in red meat sales; other factors like inspiration, health benefits, and provenance messaging matter, as highlighted by AHDB research.

The impact of weather on red meat cuts

A late falling Easter in 2025 meant we had favourable weather, with the UK experiencing 106 more sunshine hours in April than the previous year (Met Office Sunshine Hours UK). This likely encouraged outdoor cooking, reflected in £99.8m spent on red meat BBQ cuts (burgers, sausages and steaks); a 9.4% increase in spend and 2.3% increase in volumes purchased (Kantar, 2 w/e 20 April 2025).

Beef burgers were the big winners with a 26.5% volume increase, while lamb burger volumes soared by 73.4%. However, it doesn’t appear that the traditional roast was being replaced for less conventional cuts.

Supermarkets vs butchers

Supermarkets dominated red meat roasting joint sales, accounting for 75% of purchases (+0.2% vs Easter 2024). Butchers suffered a significant decline, dropping 24.3% in volume and holding only a 2% market share (Kantar, 2 w/e 20 April 2025).

The overall decline in primary red meat purchases this Easter will have likely hindered butchers’ performance as this is a key area they specialise in, but equally so will have the increased promotional activity offered by supermarkets.

Recommendations for Easter 2026

- Easter 2026 will fall on 6 April. As this will be two weeks earlier than 2025, there is potential for more variable weather. Ensuring both indoor and outdoor dining is catered to, and that there are flexible product offerings and marketing that appeals to both traditional and alternative Easter meals will be important.

- While the majority of sales were seen on promotion, non-promotional sales were influential in the potential success of primary red meat roasting joints. This shows that while price promotions are important to the category, they should not be solely relied on. Supermarkets should look at how they can promote red meat enjoyment at Easter through inspiration, health, farming and provenance messaging

- Given that the majority of red meat roasting joints were purchased in the week leading up to Easter and deal-seeking behaviours of shoppers for making purchases, retailers should optimise timing and channels for highlighting promotions and messaging and try to encourage earlier purchasing.

*Note – Easters are compared to equivalent Easters in previous years due to the event moving on an annual basis. Easter 2025 refers to 2 w/e 20 April 2025 and Easter 2024 is the 2w/e 31 March 2024.