Wednesday, 18 June 2025

- UK feed wheat futures (Nov-25) rose by £2.80/t (1.6%) yesterday, closing at £180.80/t, the highest level in nearly four weeks. The May-26 contract also climbed, gaining £2.45/t (1.3%) to settle at £191.25/t.

- Domestic wheat prices followed movements in global markets, as a slow US harvest prompted short covering by speculators. As at 15 June, only 10% of the US winter wheat crop had been harvested, below the five-year average of 16% (USDA). Dec-25 Chicago wheat and Paris milling wheat futures gained 2.3% and 1.3% respectively.

- Paris rapeseed futures (Nov-25) closed yesterday at €499.00/t, up €3.25/t. The market found support from stronger soyabean prices, with Nov-25 Chicago soyabean futures rising by 0.7%, driven by strength in energy markets (see further details below).

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Renewed tensions in the Middle East are once again driving volatility in global energy markets. On Friday (13 June), Israel launched airstrikes on Iranian nuclear sites, prompting a retaliatory response from Iran.

This latest escalation has raised concerns about potential disruptions to global energy supplies. Iran is a major crude oil producer with substantial natural gas reserves, while Israel remains a key regional energy player. In addition, the Strait of Hormuz, through which around 20% of the world’s oil passes, lies near Iran. Any threat to this vital corridor could significantly restrict global supply.

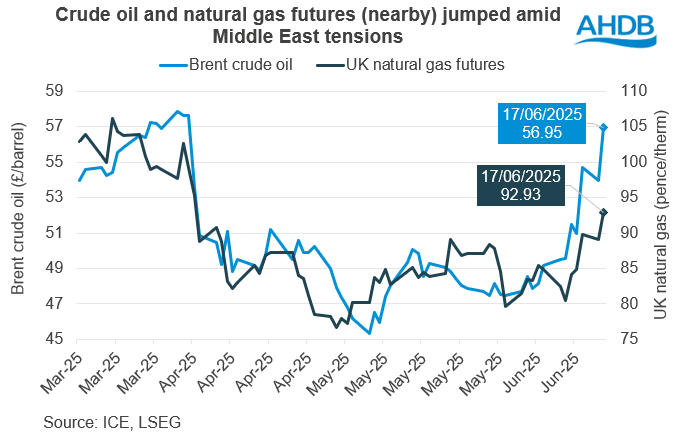

Energy prices have surged in response. From 12 – 17 June, nearby Brent crude futures have jumped 12% to £56.95 per barrel, the highest price since early April. UK natural gas futures (nearby) also rose 9%, reaching 92.93p per therm.

Could rising tensions affect grain and oilseed markets?

Both Israel and Iran are large importers of grains and oilseeds. According to the latest USDA outlook, the two countries are forecast to import a combined 15.0 Mt of grains and 3.0 Mt of oilseeds during the 2024/25 season. Further conflict could weaken demand in the region, potentially putting downward pressure on global prices.

What does this mean for fertiliser prices?

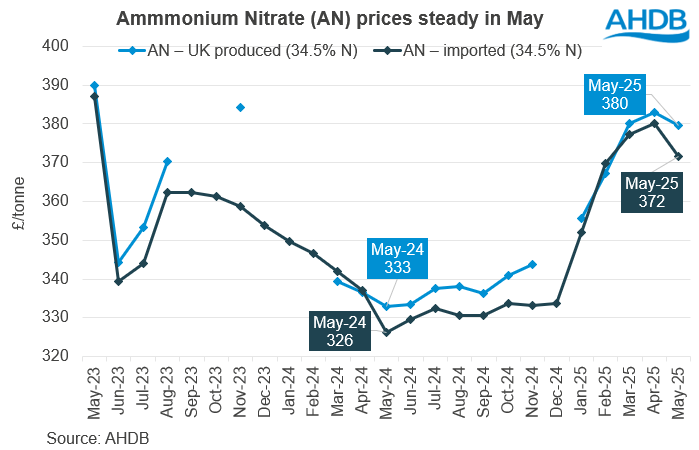

Rising energy costs have a knock-on effect on fertiliser prices, particularly nitrogen-based products, which are highly energy-intensive to produce. According to the latest GB fertiliser prices, nitrogen fertiliser costs remain relatively high. Imported ammonium nitrate (AN) for May 2025 was quoted at £372/t, down £9/t from April, and £45/t more than in May 2024. UK-produced AN was quoted slightly higher at £380/t for May.

Meanwhile, phosphate and potash fertiliser prices edged up in May. The average spot price for Diammonium Phosphate (DAP) rose by £13/t to £618/t, the highest level since May 2023. Similarly, the average spot price for Muriate of Potash (MOP) increased slightly by £1/t to £352/t, the highest price seen since September 2024. Israel, a key potash exporter, may face supply disruptions if the conflict escalates.

Looking ahead

As harvest approaches, many farms are stocking up on fuel for combining and grain drying. Rising crude oil prices poses a direct risk to diesel costs, a key input at this time of year. Monitoring the market and planning purchases strategically will be important for cost management in the weeks ahead.

AHDB have several resources to help growers assess costs and make informed decisions, such as Nitrogen fertiliser calculator, Fertiliser outlook 2025 and Nutrient Management Guide (RB209).

Tools like Farmbench can also support farmers in managing their budgets and planning ahead.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.